Sometimes, what seems like a necessary change, and what might have been done with good intentions, ends up being far more detrimental than helpful. In the United States, from 1879 to 1933 our monetary system was based on and utilized gold. The lone exception to that was the embargo on gold exports during World War I. With the gold standard, creditors had the right to demand payment in gold. It was a stable and tangible source of income and payment, and it ensured that the borrower actually had the funds to make the payment. The bank failures during the Great Depression of the 1930s frightened the public, causing them to begin hoarding gold, making the “payment in gold” policy untenable, furthering the panic. On June 5, 1933, Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold, thereby taking the United States off the gold standard. That meant that our currency was no longer backed by gold. This may not have seemed like a bad solution at the time, but it certainly opened the door for a number of huge problems later.

Sometimes, what seems like a necessary change, and what might have been done with good intentions, ends up being far more detrimental than helpful. In the United States, from 1879 to 1933 our monetary system was based on and utilized gold. The lone exception to that was the embargo on gold exports during World War I. With the gold standard, creditors had the right to demand payment in gold. It was a stable and tangible source of income and payment, and it ensured that the borrower actually had the funds to make the payment. The bank failures during the Great Depression of the 1930s frightened the public, causing them to begin hoarding gold, making the “payment in gold” policy untenable, furthering the panic. On June 5, 1933, Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold, thereby taking the United States off the gold standard. That meant that our currency was no longer backed by gold. This may not have seemed like a bad solution at the time, but it certainly opened the door for a number of huge problems later.

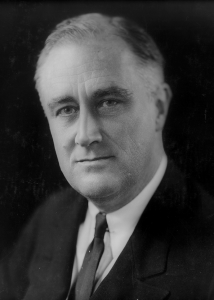

President Roosevelt had seen how this worked when Britain was facing similar pressures, and they decided to drop the gold standard in 1931. So, when the Great Depression hit, Roosevelt decided to implement it in the US. Soon after taking office in March 1933, President Roosevelt declared a nationwide bank moratorium in order to prevent a run on the banks by consumers lacking confidence in the economy. At the same time, he forbade banks from paying out gold or to exporting it. He based his decision on the Keynesian economic theory, which states that one of the best ways to fight off an economic downturn is to inflate the money supply. If the amount of gold held by the Federal Reserve is increased, it would in turn increase its power to inflate the money supply.

With that in mind, Roosevelt, on April 5, 1933, ordered all gold coins and gold certificates in denominations of more than $100 turned in for other money. The order required all persons to deliver all gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve by May 1, 1933. In exchange, they were to be given $20.67 per ounce. I’m sure it seemed like a good deal, so the people complied. By May 10, the government had taken in $300 million of gold coin and $470 million of gold certificates. Congress two months later, enacted a joint resolution repealing the gold clauses in many public and private obligations that required the debtor to repay the creditor in gold dollars of the same weight and fineness as those borrowed. To complete the inflation process, in 1934, the government price of gold was increased to $35 per ounce, effectively increasing the gold on the Federal Reserve’s balance sheets by 69 percent. This increase in assets allowed the Federal Reserve to further inflate the money supply. So, with a stroke of the pen, the Federal Reserve, and thereby the government increased their wealth by 69%…overnight.

The $35 per ounce value of gold held August 15, 1971, when President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, thus completely abandoning the gold standard. Now I’m not an economist, but if I understand this correctly, it was at that point that the United States, as well as many other nations, began using what is known as “Fiat Money.” Fiat money is “a type of currency that is not backed by a precious metal, such as gold or silver. Fiat money is an intrinsically valueless object or record that is accepted widely as a means of payment. Accordingly, the value of fiat money is greater than the value of its metal or paper content.” It is designated by the issuing government to be legal

tender and it was authorized by government regulations, which means that the government could decide what its value would be. That would render the money to be worthless. Not that it changed much in the amounts of Fiat money in use at the time, but in 1974, President Gerald Ford signed legislation that permitted Americans to own gold bullion again.

tender and it was authorized by government regulations, which means that the government could decide what its value would be. That would render the money to be worthless. Not that it changed much in the amounts of Fiat money in use at the time, but in 1974, President Gerald Ford signed legislation that permitted Americans to own gold bullion again.

Leave a Reply