greenbacks

During the Civil War, money was made out of silver and gold. People would not have trusted any other form of money, but having enough silver and gold to make that money wasn’t always easy. The Northern states needed money, and they knew they had to make it, but Congress and others were concerned for the economy. If the government made money without silver or gold to back it, wouldn’t it eventually doom the economy? Most of us would call that counterfeit money, and yet our government is still doing this at times, more than we want to think about. Nevertheless, if you are part of the government, or even just someone who understands how such money can effect the economy, you might very likely be against something like the Legal Tender Act that was passed by the US Congress on this day, February 25, 1862.

During the Civil War, money was made out of silver and gold. People would not have trusted any other form of money, but having enough silver and gold to make that money wasn’t always easy. The Northern states needed money, and they knew they had to make it, but Congress and others were concerned for the economy. If the government made money without silver or gold to back it, wouldn’t it eventually doom the economy? Most of us would call that counterfeit money, and yet our government is still doing this at times, more than we want to think about. Nevertheless, if you are part of the government, or even just someone who understands how such money can effect the economy, you might very likely be against something like the Legal Tender Act that was passed by the US Congress on this day, February 25, 1862.

This was a huge step. Prior to this time, the money was real money. It needed no proof that its value was real,  the people using it could see that for themselves. The United States didn’t have money that was basically an I.O.U. before that time. The problem was that they also had a war going on that cost a lot of money, and with people fighting the war, there were a lot less people to go out and look for gold and mine silver. It was a big problem, but the Civil War was extremely costly, and it had to be financed. The government had to face the fact that the supply of gold and silver was depleted. The Legal Tender Act was not a decision they came to lightly. They discussed every other option, including bonds. Once they settled on paper money, the Union government printed 150 million dollars in paper money…called greenbacks. The Confederate government had been printing money since the beginning of the war, which proved to be folly in the end, but I guess if the south had won, it would have gone the other way. Nevertheless, the bankers and financial experts predicted doom immediately, and many legislators worried that the money might collapse the infrastructure.

the people using it could see that for themselves. The United States didn’t have money that was basically an I.O.U. before that time. The problem was that they also had a war going on that cost a lot of money, and with people fighting the war, there were a lot less people to go out and look for gold and mine silver. It was a big problem, but the Civil War was extremely costly, and it had to be financed. The government had to face the fact that the supply of gold and silver was depleted. The Legal Tender Act was not a decision they came to lightly. They discussed every other option, including bonds. Once they settled on paper money, the Union government printed 150 million dollars in paper money…called greenbacks. The Confederate government had been printing money since the beginning of the war, which proved to be folly in the end, but I guess if the south had won, it would have gone the other way. Nevertheless, the bankers and financial experts predicted doom immediately, and many legislators worried that the money might collapse the infrastructure.

The greenbacks did not sink the economy. In fact, they worked very well. The government was able to pay its bills and, by increasing the money in circulation, the Northern economy actually improved. The greenbacks were legal tender, which meant that creditors had to accept them at face value. Life went on, but there were repercussions from the new money. In 1862, Congress was forced to pass an income tax and steep excise taxes, designed to cool the inflationary pressures created by the greenbacks. In 1863, another legal tender act was passed, and by the war’s end nearly half a billion dollars in greenbacks had been issued. The Legal Tender Act laid the foundation for the creation of a permanent currency in the decades after the Civil War.

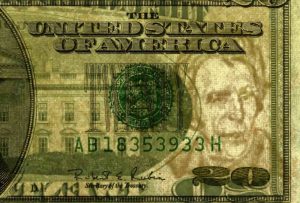

Have you ever wondered why US money is green…or mostly green, while the money of so many other countries is very colorful? How did paper money come about anyway? Actually, paper money has been around in the United States since the beginning, off and on anyway. Printing paper money has been a controversial practice over the years. In 1861, as a means of financing the American Civil War, the federal government began issuing paper money for the first time since the Continental Congress printed currency to help pay for the Revolutionary War. The earlier form of paper dollars, dubbed continentals, were produced in such high volume that they soon lost much of their value. Devaluing our money has been a long standing problem with paper money. It’s simply too easy to print more money than we have gold to back.

Have you ever wondered why US money is green…or mostly green, while the money of so many other countries is very colorful? How did paper money come about anyway? Actually, paper money has been around in the United States since the beginning, off and on anyway. Printing paper money has been a controversial practice over the years. In 1861, as a means of financing the American Civil War, the federal government began issuing paper money for the first time since the Continental Congress printed currency to help pay for the Revolutionary War. The earlier form of paper dollars, dubbed continentals, were produced in such high volume that they soon lost much of their value. Devaluing our money has been a long standing problem with paper money. It’s simply too easy to print more money than we have gold to back.

In the decades before the Civil War, private, state chartered banks printed the paper money. Not surprisingly, this resulted in a wide variety of denominations and designs. Apparently, there was no real decision on how this should look. I guess they weren’t really worried about counterfeiting at that time. The bills that came out in the 1860s became known as greenbacks, because their backsides were printed in green ink. This ink was used as an anti-counterfeiting measure used to prevent photographic knockoffs, since the cameras of the time could only take pictures in black and white. I guess that counterfeiting had become a problem in the earlier years after all. And as we all know, the new scanners continue to improve the possibility of counterfeiting, making watermarks and security strips necessary too. And they have also added color to the money these days.

In 1929, the federal government decided that the paper money was too expensive to print, so in an effort to cut costs, they shrunk the size of all paper money. At the same time, they standardized the designs for each denomination, which made it easier for people to tell the difference between real and counterfeit bills. The new, more compact bills continued to be printed in green ink, because according to the US Bureau of Printing and Engraving, the ink was readily available and durable. They also thought that the color green represented stability. Today, there is some $1.2 trillion in coins and paper money in circulation in America. It costs about 5 cents to produce every $1 bill and around 13 cents to make a $100 bill, the highest denomination currently in

circulation. Don’t ask me why the difference, I would have expected them to be pretty much the same cost to manufacture. The estimated life span of a $1 bill is close to six years, while a $100 bill typically lasts 15 years, which makes sense to me, because we don’t use the $100 bill nearly as much. The $50 bill has the shortest average life span, at 3.7 years, and I would have expected the shortest lifespan to be the $1 bill, because we us those all the time.

circulation. Don’t ask me why the difference, I would have expected them to be pretty much the same cost to manufacture. The estimated life span of a $1 bill is close to six years, while a $100 bill typically lasts 15 years, which makes sense to me, because we don’t use the $100 bill nearly as much. The $50 bill has the shortest average life span, at 3.7 years, and I would have expected the shortest lifespan to be the $1 bill, because we us those all the time.